Investments

Objective and Approach

The objective of risk management is to put in place effective policies, mechanisms, systems, and processes for investment and operations to maximize the returns for the shareholder within an acceptable risk tolerance.

Risk management is a company-wide effort involving every business line, department, and individual. It is embedded throughout the investment life cycle, from the overall portfolio to general asset classes and to specific investment strategies and sub-strategies.

System and Mechanism

CIC’s comprehensive risk management system addresses eleven types of risk: market risk, credit risk, operational risk, liquidity risk, country risk, strategy risk, legal risk, reputational risk, geopolitical risk, information technology risk, and corruption risk. To ensure the orderly operation of investment activities within our risk tolerance, the company continues to enrich its risk management toolkits for all portfolio tiers, including the total portfolio, asset classes, and strategies/deals.

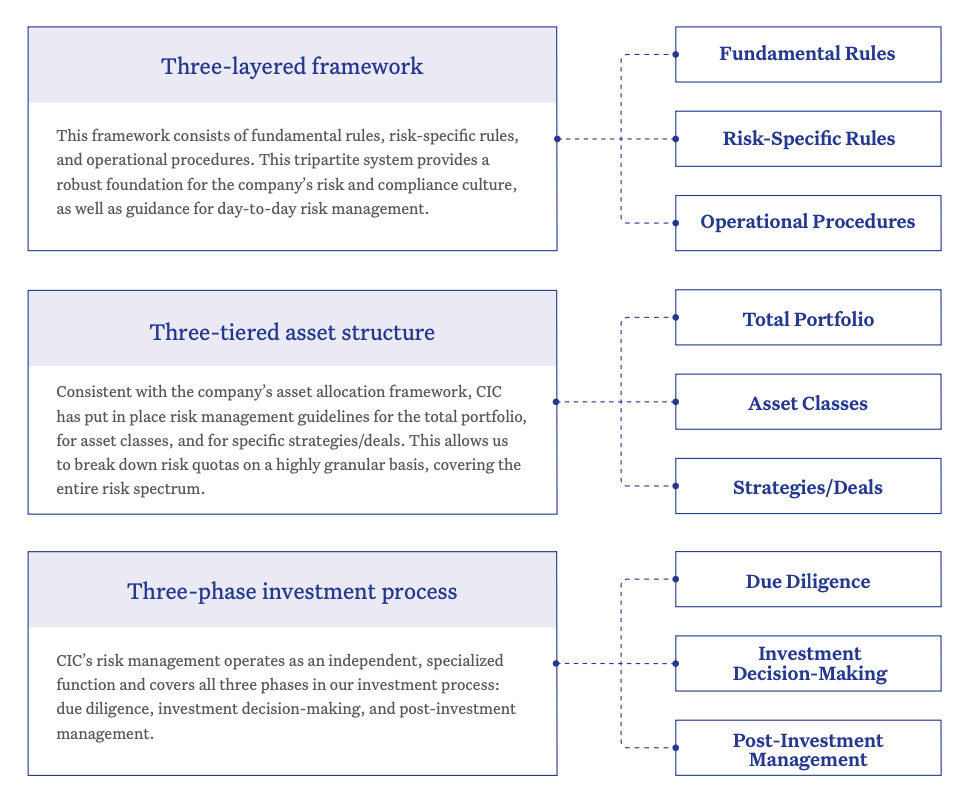

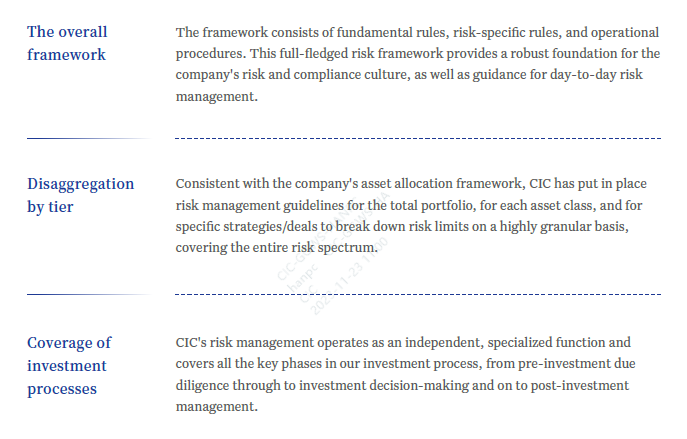

• Risk Management Characteristics

CIC adopts a sound risk management system as outlined below to effectively manage risk.

• Risk Management Organization

The company further enhanced its risk governance framework by establishing a Risk Management Committee under the Board of Directors. The company also put in place a Comprehensive Risk Management Committee under the Executive Committee and three subcommittees to further boost risk management capabilities in their respective areas.

• Comprehensive Risk Management

In 2022, CIC proactively addressed various risks and challenges in an exceptionally complex and volatile environment by taking additional steps to build an increasingly robust and effective risk management framework that guards against material and novel risks. The company further refined its multi-scenario contingency plans for risk events in its overseas investments and conducted stress tests and business continuity simulations around extreme scenarios. It closely monitored risks at the deal and portfolio levels and bolstered pre-investment risk assessment and post-investment risk controls. These efforts were successful in protecting the company against major risk incidents.

Market Risk Management

Based on its monitoring and evaluation of changing market conditions, CIC developed prudent asset allocation plans and updated its risk policies. The company planned its annual risk budget, rebalanced its portfolio allocations on multiple occasions, optimized the tail-risk hedging portfolio, performed dynamic stress tests, and updated liquidity provisions. Our enhanced look-through risk management allowed us to better examine potential risks of private alternative asset deals through a multi-dimensional and more granular lens. We conducted forward-looking analyses on trending market themes, with a particular focus on management under stressed market conditions, hedge funds’ macro adaptability, and the monetary policy of major central banks.

Credit Risk Management

Regular updates were provided via our Sovereign Credit Risk Report, including analysis of global sovereign credit risk trends. We performed debt sustainability tests on major economies and updated the sovereign credit scores of investment recipient countries and regions to account for prevailing country risks. We also continued to track changes in the credit risk of our investees.

Internal Control and Operational Risk Management

CIC evaluated the effectiveness of internal control and operational risk management policies in priority areas, and improved the communication, enforcement, and supervision thereof. Improved investment authorization policies made decision-making more efficient, and more robust accountability requirements strengthened the role of investment managers as the first line of defense. The company formalized routine inspections of post-investment management activities and carried out targeted checks. It also took stock of risk factors in specific investment activities to enhance operational risk management.

Reputational and Compliance Risk Management

CIC strictly complies with the laws and regulations of all its investment destinations, respects local community concerns, and ensures information disclosure as required by law. The company continued to improve reporting, coordination, identification, and mitigation around potential issues in line with company requirements and processes for reputational risk management. Thanks to its diligence around compliance, CIC has earned widespread recognition as a responsible corporate citizen and respected partner.

Corruption Risk Management

CIC took steps to improve consultation, reporting, and accountability mechanisms for the management of corruption risk. Ongoing assessments led us to update the company’s Handbook for Managing Corruption Risks Overseas, reflecting the findings of our risk level evaluations and further strengthening relevant prevention and control measures.

Geopolitical Risk Management

CIC enhanced its geopolitical risk control system and strengthened its forward-looking analytical capabilities to systematically upgrade its management of geopolitical risks.

IT Risk Management

CIC conducted comprehensive reviews of security risks in the areas of data and information, software and hardware, and devices and systems and systematically bolstered the company’s protection against data and network security threats.