Investments

Following a “one CIC, one portfolio” philosophy, the company has evolved a total portfolio allocation management framework that is adapted to the institution’s needs, ensures clear lines of authority and accountability, and prioritizes quality and resilience. This framework begins with awareness of the big picture, long-term objectives, and mega trends; reflects CIC’s own characteristics and investment philosophies; integrates academic and industry research and application; and draws on best practices of top-tier international institutional investors.

The company has adopted a portfolio construction framework that consists of a reference portfolio, a policy portfolio, and the actual portfolio. Under this framework, total portfolio returns are determined by reference portfolio selection, policy portfolio construction, and actual portfolio management.

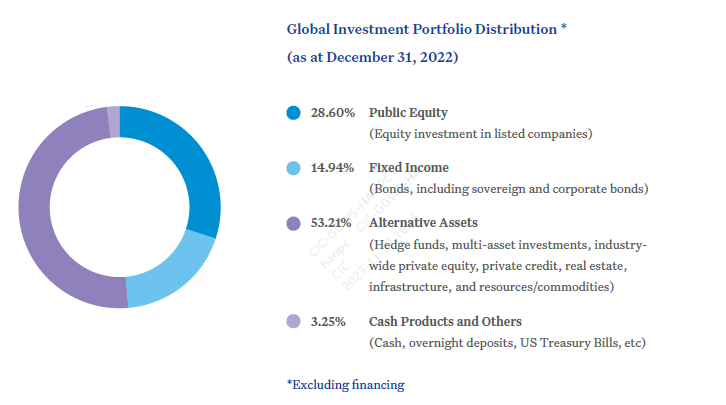

CIC has built a balanced, robust investment portfolio across different asset classes including public equities, fixed income, alternative assets, cash products and others.

A major paradigm shift took place in 2022. The macro environment for outbound investment changed materially as the ‘trilemma’ of high interest rates, high inflation, and high volatility set in, ending a two-decade era of rapid growth and low inflation. Risk events became more frequent and more intense. As growth slowed and inflation remained elevated, the swing of the macro pendulum accelerated. With inflation levels in the U.S. and Europe reaching 40-year highs, major central banks tightened monetary policy significantly. The geopolitical landscape became increasingly complex. Economic uncertainty increased substantially, and financial markets exhibited heightened fragility and volatility as the traditional asset classes of stocks and bonds declined in unison. International currency markets experienced intense volatility, and commodity prices saw major swings and divergent increases. Private market investment valuations came under pressure.

Faced with this complex and volatile global market environment and its unprecedented challenges, CIC took the following actions:

• We maintained our strategic focus; adhered to the general guideline of pursuing progress while preserving stability; implemented the new development philosophy thoroughly, accurately, and comprehensively; and remained anchored in our identity as a long-term institutional investor that operates on an international, market-oriented, professional, and responsible basis.

• We monitored and anticipated changes in market conditions, formulated prudent asset allocation plans, actively repositioned our portfolio to enhance our defensive position, and effectively reduced total portfolio risk by capturing market opportunities. We also optimized the operation and management of the tail-risk hedging portfolio, expanded the portfolio management toolkit, carried out ongoing stress tests, strengthened liquidity management, and coordinated responses at all levels of the portfolio..

• We deepened the reform of our overseas investment management system, harmonized decision-making processes for private market investments, streamlined investment departments, and bolstered the ranks of our dedicated investment committee members to bring yet greater rigor and professionalism to our investment management activities.

• We fine-tuned our mix of public market investments and effectively adapted our strategies and portfolios to increasingly complex market conditions.

• We advanced our private market investments with dual emphasis on quality and quantity, strengthened strategic and thematic research, deepened investment partnership management, prioritized post-investment management of key deals, and raised the ratio of alternative assets in our overseas investment portfolio to 50%, a target set out in our 2018-2022 strategic plan.

In sum, CIC’s overseas investment business withstood the challenges of material risk events including the COVID pandemic, geopolitical conflicts, and significant market declines. Our overseas investment returns beat the reference portfolio for the third year in a row and met the 10-year rolling performance target.

Public Market Investments: Refining Strategy to Continuously Improve Investment Performance

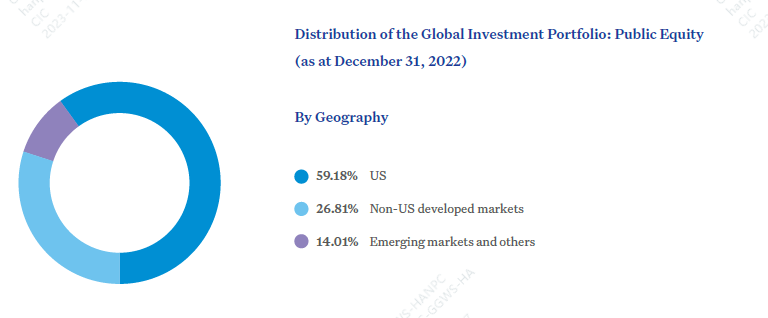

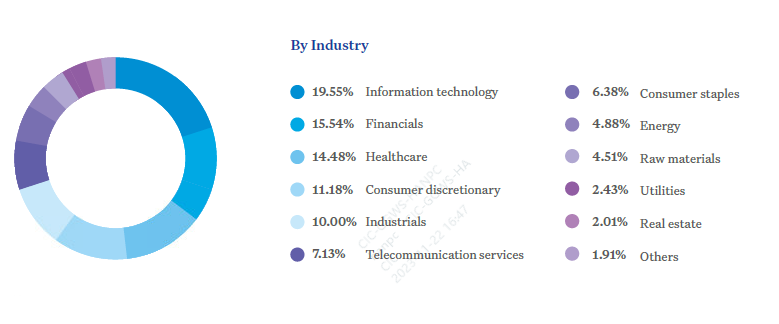

CIC effectively navigated market challenges and volatility in 2022 by fine-tuning/adjusting its investment footprint in public markets and by strengthening alignment between its internally and externally managed investments. The company carried out in-depth investment performance reviews, pushed ahead with adjustments to investment styles and managers, and strengthened inhouse capacities for sectoral, geographical, and custom index investing, making its strategies and portfolios more adaptable to market dynamics.

Public equities: CIC actively improved portfolio analytics by enhancing the resilience of its analytical system , further harmonized strategy management, and optimized portfolio construction. The company explored the establishment of a semi-passive/exposure position portfolio for public equities to enhance diversification and rebalancing flexibility. On the sustainable investing front, the company stepped up its research into relevant investment themes, explored new modalities of strategy construction, and boosted its independent institutional investment capabilities.

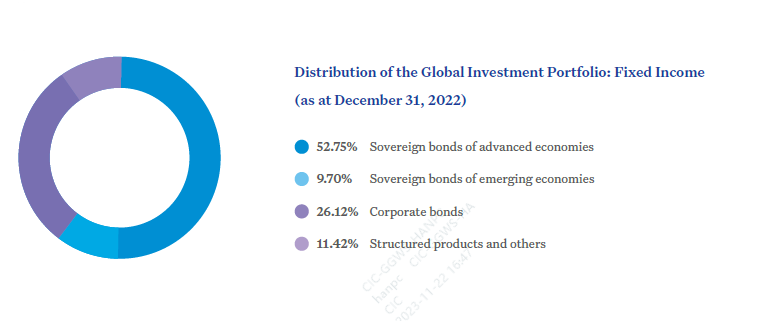

Fixed income and absolute return: CIC continued to fine-tune the active management of its proprietary fixed income portfolio to support corporate level allocation adjustments and meet the company’s liquidity needs. The composition of the hedge fund portfolio was optimized to further enhance its ability to capture alphas with low correlation to public markets. For its multi-asset risk allocation strategy, the company adjusted its allocation to external managers based on its evaluation of market conditions. We also launched the CIC proprietary macro factor portfolio and completed the development of relevant infrastructure for investment management and performance analytics. Additionally, the company continued to strengthen its macro research and in-house investment capabilities and pursued greater synergies between its internally and externally managed investments.

Private Market Investments: Pursuing Excellence with Improved Investment Capabilities

CIC continued to strengthen its strategic and thematic research capabilities and deepened its investment partnerships to build institutional co-investment and co-sponsorship capacities. Key investment deals benefited from enhanced post-investment management. The company also continued to employ innovative approaches to outbound investment and consolidated and expand edits investments in the bilateral funds, leveraging its role as a sovereign wealth fund to promote international industrial cooperation. Amidst the turbulent market environment, CIC moved steadily ahead with its private market investments throughout 2022 and successfully achieved its alternative asset allocation target under the five-year strategic plan.

Private equity and private credit: Fund investments recorded steady progress thanks to the company’s judicious engagement of top-tier GPs and portfolio optimizations. The company leveraged in-depth sectoral research to seize investment opportunities in the market. It executed investments in key industries such as TMT (technology, media, and telecom), healthcare, consumer services, high-end manufacturing, fintech, and business services, and expanded co-investment partnerships. In parallel, we sought out new investment opportunities in themes such as climate change, new energy, and software. Backed by our in-depth market research, we also capitalized on opportunities arising from global inflation and interest rate hikes, and upped our investment indirect lending and real asset-backed financing deals. We also explored ways to better create value and share the accruing benefits with our partners. Periods of market volatility were used to further strengthen and fine-tune post-investment management and portfolio management.

Real estate:Real estate continued to serve as a defensive asset class and shield against inflation. With a focus on the investment theme of “demographics + technology + sustainability”, CIC in particular eyed logistics property, rental apartments, and other segments that can offer inflation protection. As part of its portfolio optimization, the company also adjusted the portfolio’s exposure to industry segments and geographies to enhance portfolio adaptability, resilience, and growth in the new market environment.

Infrastructure:CIC’s post-investment management and new investments have proven to be highly effective, supported by the company’s strong insights into market trends and dynamics. Our close monitoring of key investments has helped generate stable growth and robust returns across our infrastructure assets against a challenging environment marked by high inflation, rising interest rates, and slowing growth. In-depth sectoral research around energy transition, energy storage, data centers, and regulated assets has enabled the company to fine-tune its investment priorities and strategies, further rebalance allocations across geographies and sectors, and diversify investment risks, increasing exposure to the Asia Pacific region and to sub-sectors such as digital infrastructure, power/renewables, and public utilities.

Energy and resources:The company has closely monitored the health of its assets, enhanced post-investment management, and guarded against risks, while seizing the right opportunities to exit investments on the back of a strong commodity cycle. The company has continued to focus on energy-security-related opportunities amidst intensifying geopolitical risks. It has actively pursued investment opportunities arising from the energy transition, progressively increased exposure to green energy, selected fund managers with strong sector expertise and track records, and adopted novel approaches to working with managers leveraging CIC’s extensive resources in China.

Agriculture and food:Taking a research-driven approach, CIC increased its agriculture and food investments and further expanded its footprint across the agricultural value chain. We seek to build an investment ecosystem by establishing long-term relationships with major investors in this sector. Together with leading international and Chinese partners, CIC co-sponsored multiple deals with a view to creating value. Our ability to bridge markets is central to the CIC brand and to our competitive advantage in this space.

Bilateral funds:By leveraging these cooperative mechanisms to deploy investments and capture opportunities for value creation, CIC connects portfolio companies with the China market and with Chinese industry partners, advancing international industry and investment cooperation.

CIC maintained a steady investment pace in its bilateral funds. In building a cross-border investment ecosystem and promoting international industrial cooperation, the company has fully leveraged China’s vast domestic market to enable portfolio companies to thrive. This has enhanced returns and earnings, informed investment decisions in relevant countries, and driven industrial synergies, advancing high-quality international investment and industry cooperation.

Overseas Offices: Pursuing Principled Innovation, Deepening Localization, and Unlocking Synergies

CIC International (Hong Kong) prudently managed portfolio risk in its public market investments and actively responded to market challenges. The company took advantage of its presence in Hong Kong to closely monitor market dynamics in the region and around the globe, engage in active exchanges and interactions with peer institutions, and support China’s national development. With a focus on the Guangdong-Hong Kong-Macau Greater Bay Area and growing reach across the Asia Pacific region, CIC International (Hong Kong) actively synergized with the head office in deal sourcing and post-investment management.

In 2022, which marked the 25th anniversary of the return of Hong Kong to the motherland, CIC International (Hong Kong) fully leveraged Hong Kong’s locational strength, actively participated in Hong Kong’s financial markets, and sought and seized investment opportunities that helped raise Hong Kong’s profile as an international financial center and develop the Northern Metropolis. The office maintained close liaison and cooperation with its Hong Kong peers and strengthen edits investment research capabilities, further cementing its reputation as a professional, active participant in Hong Kong’s financial markets.

CIC New York Representative Office closely monitored developments in the U.S. legal and regulatory environment, strengthened engagement with local business partners, and conducted in-depth research on economic and investment trends in the U.S. market. It participated in post-investment management and on-site due diligence for deals in the Americas and assisted the head office in liaising with multiple new managers and vetting potential investment opportunities.

CIC is a long-term institutional investor with a 10-year investment horizon that applies annualized rolling returns as its key performance metric.

As at December 31, 2022, CIC’s annualized cumulative 10-year net return stood at 6.43%, beating the 10- year performance target by 26 basis points. Its annualized cumulative net return since inception stood at 5.94%. All the above figures are calculated on a USD value basis.

Investment Performance on the Global Portfolio (all measured in US$)

a. Net cumulative annualized returns and the annual return for 2008 are calculated since inception on 29 September 2007.